- [email protected]

- Address placeholder, Country

Understanding how to make a will is an essential step in managing your affairs and ensuring that your assets are distributed according to your wishes after you pass away. It’s a process that enables you to decide exactly who will inherit your property, money, and possessions, making it a vital document for peace of mind. Writing a will can also make things much simpler and clearer for your loved ones during a difficult time, potentially reducing any additional stress and confusion.

To begin making a will, it’s important to take stock of your assets and debts, identify beneficiaries, and think about who you would like to appoint as the executor – the person responsible for administering your estate. It’s crucial that the will meets all legal requirements to be valid; otherwise, it could be contested, leading to family disputes. Given the potential complexities, many opt for professional advice to navigate the intricacies of estate law and ensure their will accurately reflects their intentions.

When preparing for the future, understanding the intricacies of wills is crucial. They are legal documents that ensure your assets are distributed according to your wishes after your passing.

A will, at its core, is a legal document where you detail how you would like your estate to be handled after you die. It’s imperative to have a clear, legally recognised will to prevent disputes and ensure that your assets are distributed according to your preferences. Without a will, your estate might be divided under the rules of intestacy, which may not align with your wishes.

There are several types of wills that cater to different needs and circumstances:

Each type of will serves unique purposes and carries its own set of legal requirements and complexities. It is advised to seek legal counsel when choosing the will most suited to your situation, whether it’s a simple will or one involving more complex arrangements, such as a testamentary trust will.

Before drafting your will, it’s essential to have a comprehensive understanding of your assets and the people you wish to inherit them. The process requires careful consideration to ensure your estate is distributed according to your wishes.

Begin by creating a detailed inventory of your assets. This includes both tangible and intangible assets. For tangible assets, list your property, vehicles, jewellery, and any other personal belongings of value. Intangible assets should include savings accounts, stocks, bonds, pension plans, and life insurance policies. For each asset, note its approximate value, location, and any relevant account numbers or legal documents.

Next, you’ll need to designate beneficiaries for each asset. Consider who you want to inherit your assets, including primary and contingent beneficiaries. Keep in mind that some assets, like insurance policies and retirement accounts, often have beneficiaries already assigned, so you’ll want to ensure these designations align with your will.

It’s crucial that the names of your beneficiaries are spelt correctly and clearly identified with their current contact information. Remember to review and update your beneficiary designations periodically or when life changes occur.

When you make a will, selecting an executor is a pivotal decision. This individual will be tasked with managing your estate, adhering to the directives of your will, and ensuring that your assets are distributed according to your wishes.

The executor has a range of duties, which include:

It’s a role requiring thoroughness and integrity, as highlighted by the MoneyHelper website.

Choose an executor by considering:

When making your will, it’s essential to comply with specific legal requirements to ensure it’s valid. Failing to do so may render your will void and your estate could be distributed in a way that doesn’t reflect your wishes.

Your will must be signed in the presence of two witnesses, both of whom are over 18 years of age. These witnesses cannot be beneficiaries in the will or married to a beneficiary, as this could invalidate their entitlement. Each witness must observe you signing the will and then sign it themselves to confirm your signature.

For a will to be legally recognised, it must be written and signed by you, the testator, while you are of sound mind, and not under any undue influence. The will should explicitly distribute your assets and may appoint an executor. It must adhere to the laws of England and Wales, and for added assurance, you may register it or have it checked by a legal professional.

When crafting your will, it’s crucial to clearly articulate your wishes and appoint trusted guardians if necessary. This ensures that your estate is managed and distributed according to your preferences.

Assets: List your assets comprehensively, including property, bank accounts, and personal items. Use clear descriptions to avoid ambiguity.

Physical Items: Describe items distinctly to prevent confusion. If necessary, include serial numbers or unique identifiers.

If you have children under 18, nominating a guardian is one of the most critical decisions.

By addressing these details with precision, your will is more likely to reflect your true intentions and stand up to legal scrutiny. For more detailed guidelines on will writing, proper witnessing, and other requirements, you may visit the UK government’s advice on writing your will or seek guidance from Citizens Advice.

After finalising your will, ensuring its security and confidentiality is paramount. This goes beyond simply choosing a safe spot; it requires strategic planning to ensure that your will is protected yet accessible to the right individuals when necessary.

At Home: You might opt to store your will at home in a lockable filing cabinet or safe. However, it’s crucial that someone you trust knows the exact location and how to access it in the event of your death.

With a Solicitor: Many choose to leave their will with a solicitor for safekeeping. Solicitors often offer secure storage facilities specifically for this purpose and will ensure your will is safe from theft, loss or damage.

At a Bank: Some banks provide safety deposit boxes suitable for storing important documents like wills. Be aware that accessing the will might be difficult outside of banking hours or without the correct authorisation. We do NOT recommend this way as banks often can’t open deposit boxes with out a grant of probate, which you can’t get without a Will!

The Principal Registry of the Family Division: Your will can be stored with the court service. For a small fee, they will keep your will safe, and it can only be accessed or retrieved by you or, upon your death, someone with the proper authority.

With Xwills.com : For only £4/month, that’s less than 15p a day you can store your Will in a fireproof/floodproof location and have your Will registered at the National Will Register so your Executors can find it easily.

Granting Access: Explicitly designate who has permission to access your will. Typically, this should be the executor(s) named in your will. Ensure they are aware of the location and any necessary procedures to retrieve the document.

Maintaining Confidentiality: Limit knowledge of your will’s contents and storage to essential parties only. This generally includes your solicitor and the executor(s). Remember, the details of your will are private and should be disclosed at your discretion.

Your will is a key document; treat it with utmost care. Make sure your chosen storage option balances accessibility with security to uphold the integrity of your final wishes.

When drafting your will, understand it is not a static document. Life changes, such as marriage, divorce, the birth of children, or the acquisition of significant assets, necessitate reviewing and updating your will to reflect your current wishes and circumstances.

Marriage or Divorce: These major life events automatically alter the distribution of your estate. Updating your will ensures it aligns with your wishes post such changes. If you have recently married, consider rewriting your will, as marriage can invalidate an existing will, depending on where you live.

Changes in Assets: When you acquire or dispose of significant assets, it is crucial to update your will to reflect your current estate. Failing to do so may lead to unintended beneficiaries or disputes among heirs.

Addition to the Family: The arrival of new family members, be they children, grandchildren, or even dependents, should prompt a revision of your will to include them as beneficiaries.

Appointment of Executors or Trustees: If your chosen executors or trustees are unable to fulfil their roles, it’s important to appoint alternatives to prevent complications in the estate administration process.

Edit Your Will Carefully: Remember, you can’t simply alter your will once it’s signed and witnessed. To make changes, you must either create a codicil or write a new will. For minor amendments, a codicil might suffice, but for substantial changes, drafting a new will is generally recommended. Whichever method you choose, it must be executed with the same formalities as your original will.

In conclusion, regular updates to your will are vital to ensure it accurately reflects your current intentions and provides clear instructions for the distribution of your estate.

When making your will, it’s crucial to consider consulting a solicitor or a professional Will Writer to ensure it is legally valid and aligns with your intentions.

You should seek out a solicitor or professional Will Writer when:

They can help if you’re concerned about someone contesting your will or if there are potential Inheritance Tax issues.

Legal advice is invaluable for how to make a Will:

Guidance from a legal expert ensures that your will is both comprehensive and complies with all current laws and regulations, like ensuring it’s properly witnessed. They can also advise on the implications of the latest case law and any updates in the inheritance tax regulations.

When creating a will, it’s crucial to understand the legal formalities, costs, and considerations specific to the UK to ensure your wishes are honoured after your passing.

In the UK, your will must be in writing and signed by you and two witnesses to be valid. These witnesses cannot be beneficiaries of the will. For detailed guidance, check the write your will section on GOV.UK.

Yes, you can draft a will without a solicitor’s/Will Writers assistance; however, to avoid common mistakes and ensure its legality, consider following a proven template or obtaining advice. Learn about the pitfalls from Citizens Advice.

Costs can vary depending on the complexity of your will and the solicitor you select. It can range from a simple will costing a hundred pounds to more complex estate planning costing more.

Consider your assets, chosen beneficiaries, executor duties, and guardians for any children. Think about specific bequests, and don’t forget digital assets. It’s important to choose an executor who can settle your affairs.

Yes, free will templates are available for straightforward situations. Ensure the template complies with UK legal standards.

Not all assets can be included in a will, such as jointly owned property or certain pension policies. Additionally, dependents’ rights and statutory limitations must be considered when drafting your will.

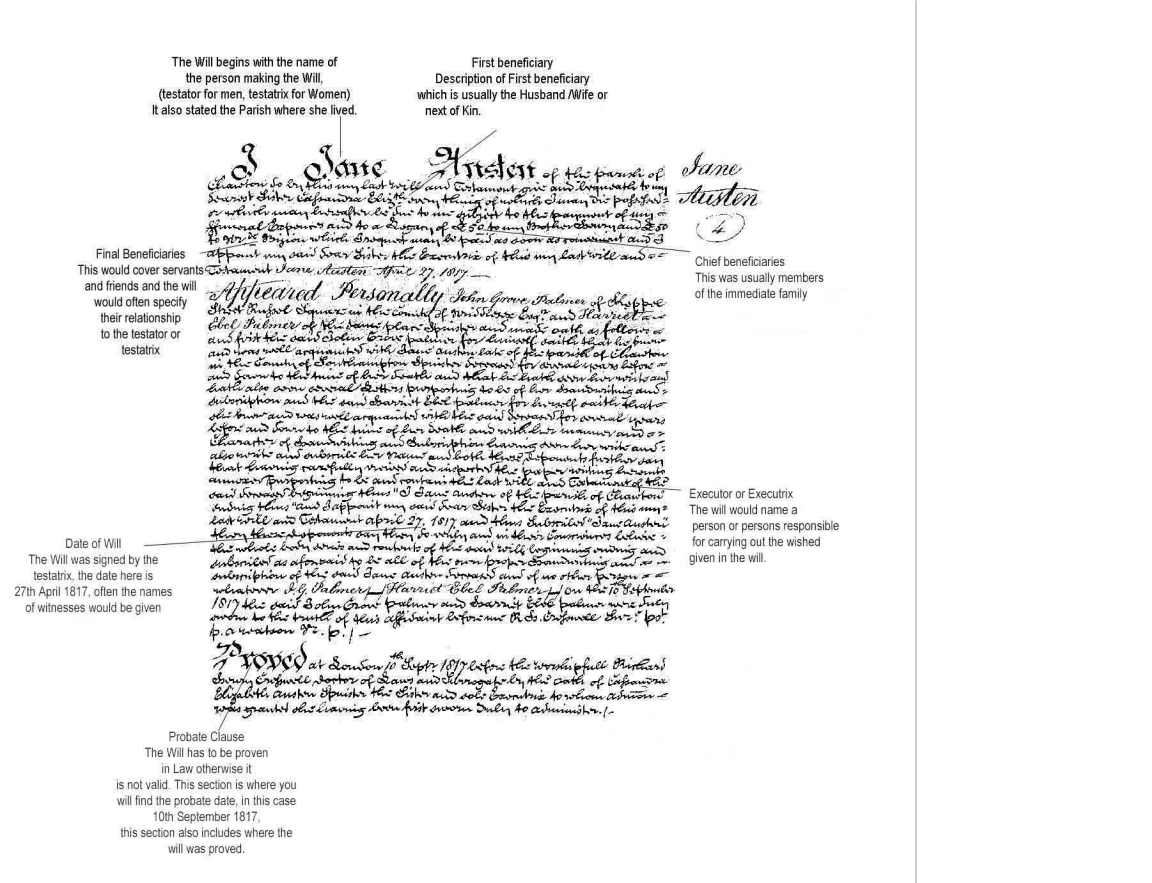

We thought it would be interesting to show how the process of making a Will has changed over the years, whilst still quite an archaic process it has moved on since the time of Jane Austen, author of Sense and Sensibility and Pride and Prejudice, amongst others – see a copy of her Will below (courtesy of the National Archives). Yours will look a lot different, we promise!

0208 064 4088

Tilsop Farm,

Nash,

Ludlow,

Shropshire

SY8 3AX