- [email protected]

- Address placeholder, Country

Understanding Inheritance Tax (Inheritance Tax) is crucial for responsible estate planning. This tax applies to the value of an estate exceeding a specific threshold upon death. This guide explores Inheritance Tax liability, thresholds, and scenarios for various relationships.

The UK government sets a tax-free threshold, also known as the Nil Rate Band (NRB), for Inheritance Tax. If your estate’s total value falls below this threshold, no Inheritance Tax is payable. The current NRB stands at £325,000 (as of April 2024).

However, things become more nuanced when considering different relationship statuses. Let’s delve into the specifics for singles, unmarried couples, and married couples/civil partners.

For single individuals, the standard Inheritance Tax rate of 40% applies to the portion of the estate exceeding the £325,000 NRB.

Imagine Emily, a single person with an estate valued at £250,000. Since this falls below the NRB, Emily’s estate won’t incur any Inheritance Tax liability.

Now, consider David, a single person with an estate valued at £500,000. Here’s the breakdown:

Estate Value: £500,000 NRB: £325,000 Taxable Estate: £500,000 – £325,000 = £175,000 Inheritance Tax Payable: 40% of £175,000 = £70,000

David’s estate will owe £70,000 in Inheritance Tax.

Unmarried couples, even those in long-term relationships, are treated as single entities for Inheritance Tax purposes. This means each partner has their own NRB.

Peter and Jane are unmarried partners with a combined estate of £450,000 (£225,000 each). Since each has their NRB, their estates won’t be liable for Inheritance Tax.

Let’s say Sarah and Michael, unmarried partners, have a combined estate of £700,000 (£350,000 each). Here’s the potential Inheritance Tax:

Sarah’s Taxable Estate: £350,000 – £325,000 = £25,000 Michael’s Taxable Estate: £350,000 – £325,000 = £25,000 Combined Inheritance Tax: 40% of (£25,000 + £25,000) = £20,000

In this scenario, the combined estate would owe £20,000 in Inheritance Tax.

Married couples and civil partners benefit from a significant Inheritance Tax advantage: the Transferable NRB allowance. This allows them to utilise each other’s unused NRB.

John and Mary, a married couple, have a combined estate of £400,000 (£200,000 each). Since their combined estate falls below the total NRB (2 x £325,000 = £650,000), they won’t incur Inheritance Tax.

David and Emily, a married couple, have a combined estate of £800,000 (£400,000 each). Here’s how the Transferable NRB helps:

Total NRB (combined): £325,000 x 2 = £650,000 Taxable Estate: £800,000 – £650,000 = £150,000

However, David might have predeceased Emily. In this case, Emily can inherit David’s unused NRB allowance, potentially reducing the Inheritance Tax liability:

Emily’s Inherited NRB: £325,000 (own) + £325,000 (inherited) = £650,000

While the scenarios above provide a basic understanding, Inheritance Tax calculations can involve additional factors:

Let’s revisit David and Emily’s scenario, considering they have a house valued at £400,000 which they plan to leave to their children:

Total Estate: £800,000 Combined NRB: £650,000 Combined RNRB (assuming both qualify): £175,000 x 2 = £350,000 Taxable Estate (without RNRB): £800,000 – £650,000 = £150,000

However, with the RNRB:

Taxable Estate (with RNRB): £150,000 – £350,000 = £0

In this scenario, thanks to the combined NRB and RNRB, David and Emily’s estate wouldn’t incur any Inheritance Tax liability.

It’s important to note: These are simplified examples. Inheritance Tax calculations can become more complex depending on your specific circumstances. Consulting a tax advisor for personalised advice is highly recommended.

There are strategies to minimise Inheritance Tax liability, and it’s wise to consider them during your lifetime. Here are a few options:

Remember, Inheritance Tax planning is a long-term strategy. Regularly reviewing your estate and financial situation is crucial to ensure your wishes are met while minimising Inheritance Tax burdens on your beneficiaries.

While briefly mentioned earlier, gifts deserve a dedicated section due to their complexities with Inheritance Tax. Here’s a deeper dive:

Important Note: HMRC can investigate gifts made within seven years of death and potentially add them back to your estate for Inheritance Tax purposes, especially if they believe the gifts were made to deliberately reduce your Inheritance Tax liability.

There are strategies to minimise Inheritance Tax liability, and it’s wise to consider them during your lifetime. Here are a few options (continued from previous section):

Whole of life insurance can be a valuable tool in your Inheritance Tax planning strategy. Here’s how it works:

To maximise the Inheritance Tax benefits of whole of life insurance, consider the following:

Important Note: Premiums paid for the whole of life insurance policy are typically considered part of your estate for the first seven years. However, after this period, the policy’s value falls outside your estate for Inheritance Tax purposes, assuming the policy is written in a trust.

While whole of life insurance offers advantages for Inheritance Tax planning, there are also some drawbacks to consider:

Premiums based on a non smoker – accurate as of 27th March 2024

Imagine John, a 40-year-old with a sizeable estate. He explores whole of life insurance and finds a policy offering £1 million coverage for a guaranteed monthly premium of £730.

This is a breakdown of how much he would have paid in premiums

Lives to 80 – £350,400

Lives to 90 – £438,000

Lives to 100 – £525,600

As you can see the payout far exceeds the premiums paid.

The key benefit lies in the £1 million payout upon John’s passing:

Premiums based on a non smoker – accurate as of 27th March 2024

Consider Sarah, a 60-year-old planning her legacy. She investigates whole of life insurance and finds a policy offering £1 million coverage for a guaranteed monthly premium of £1476. While the premiums may be higher due to her starting age, the payout still offers significant benefits:

This is a breakdown of how much she would have paid in premiums

Lives to 80 – £354,240

Lives to 90 – £531,360

Lives to 100 – £708,480

As you can see again the payout far exceeds the premiums paid.

Whole of life insurance can be a valuable tool for mitigating your Inheritance Tax liability. However, it’s just one piece of the Inheritance Tax planning puzzle. Carefully consider your circumstances, financial goals, and risk tolerance before deciding if whole of life insurance is the right fit for your strategy. Consulting a financial advisor specialising in Inheritance Tax can help you determine if and how whole of life insurance can be effectively integrated into your overall Inheritance Tax plan.

Here are some additional points to consider for effective Inheritance Tax planning:

By proactively planning for Inheritance Tax, you can achieve peace of mind. You’ll ensure your loved ones inherit your wealth with minimal financial burden and according to your wishes. Remember, knowledge is power. Utilise the resources provided, seek professional guidance, and make informed decisions to create a legacy that reflects your values and intentions.

Looking to swiftly calculate your inheritance tax liabilities? Our quick inheritance tax calculator is here below to simplify the process for you. With just a few clicks, gain insight into potential tax obligations on your estate. Our intuitive tool is designed to provide fast and accurate results, ensuring you’re equipped with the information you need to make informed financial decisions.

Whether you’re planning your estate or navigating the complexities of inheritance tax, our calculator offers convenience and efficiency. Save time and effort by accessing instant calculations tailored to your specific circumstances. Take control of your financial future today with our hassle-free, user-friendly quick inheritance tax calculator.

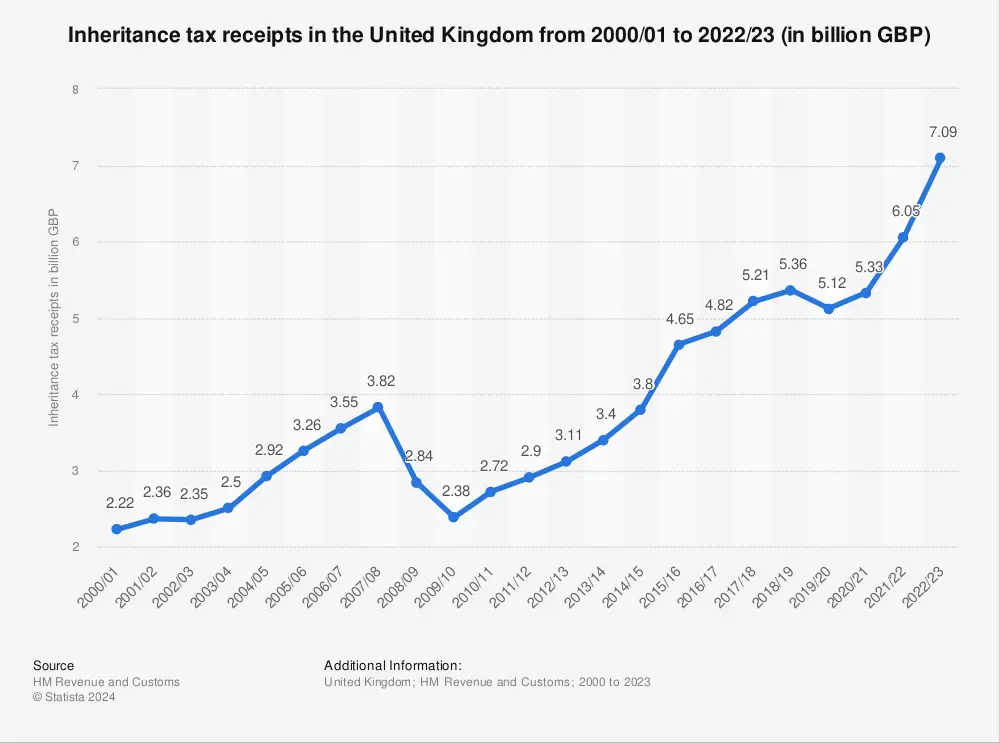

Have a look at how much Inheritance Tax was paid over the last 20 years and how much it has increased! (statistic courtesy of www.statista.com) Use our Quick Inheritance Tax Calculator below the image, then contact one of our professionals to help mitigate your Inheritance Tax bill.

0208 064 4088

Tilsop Farm,

Nash,

Ludlow,

Shropshire

SY8 3AX